With respect to the industry, COVID 19 has disrupted business due to, among others the social distancing guidelines by government and the total lockdown. Whereas many of our members invoked their Business Continuity Plans (BCPs) in order to remain relevant and competitive to effectively serve their clients and business partners, there have been some stumbling blocks that have made transacting business very difficult especially with clients that are not tech savvy. The interruption of our services has also caused us to re-think our distribution models as most of the interactions between clients and service providers is done face-to-face.

At the same time, this situation has also presented us with opportunities to explore new ways of conducting business by exploring available options. One channel we explored during this period is how we can use technology to encourage customer engagement. Through the Innovation Village’s Insurtech Lab program, an Insurteh Hackthon was carried out with this particular theme in mind and as the Association, we encouraged our members to participate in it. We anticipate that through the solutions provided, we should see alternative viable and cost-effective solutions built for the industry that take advantage of technology and help better position the industry to better engage with its customers.

We believe that as the industry and its customers continue to embrace digital solutions, we will see improved customer engagement and the provision of more tailor-made products for this market.

As the lockdown begins to ease, it is going to take a while before we can all get back to our old ways of working. The COVID 19 crisis has left a lot of damage on everything and everyone. We have to think far beyond where we are at the moment. We can not run away from the reality that technology is the way to go and therefore it is imperative on us to heavily invest in technology.

As IBAU, we remain committed to putting the interests of the insuring public as we work with our members to ensure improved visibility and growth for the industry.

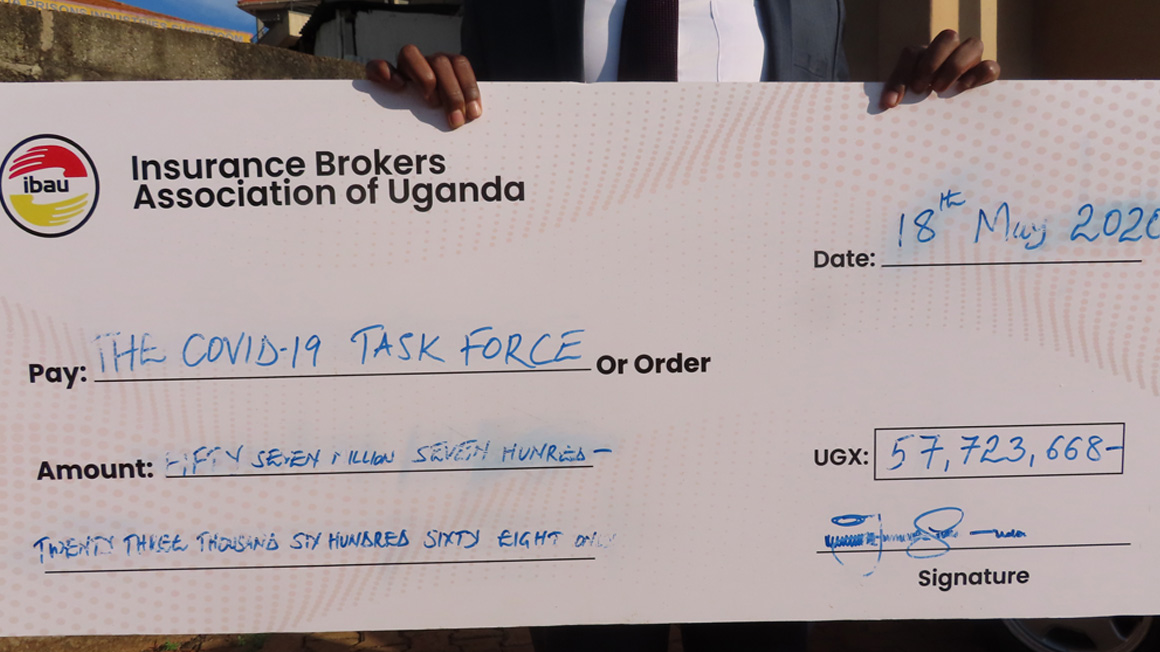

Our thanks and appreciation go out to all Insurance Brokers for their contribution and for being cheerful givers to this noble cause.

The secretariat stays committed to serving its membership during these unprecedented times.

#Stay Home #Stay Safe